In the rapidly evolving world of cryptocurrency, mining remains a cornerstone activity, driving decentralization and securing blockchain networks. With 2024 ushering in new challenges and unprecedented market volatility, the quest to maximize mining profitability has never been more critical. For miners and investors alike, understanding the nuanced interplay between hardware efficiency, energy costs, and market dynamics forms the foundational strategy for optimizing return on investment (ROI). This article delves into expert strategies designed to enhance mining profitability, particularly focusing on Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOG), and the critical role of mining rigs and hosting services.

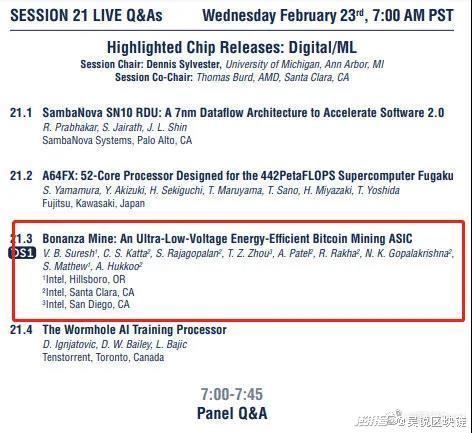

First and foremost, the choice of mining hardware dramatically impacts profitability. The surge in ASIC (Application-Specific Integrated Circuit) miners, notably for BTC, has revolutionized the mining landscape. Machines like the Antminer S19 Pro or the Whatsminer M30S++ deliver impressive hash rates paired with energy efficiency, a crucial metric considering electricity costs often constitute the lion’s share of operational expenses. Equally important is the consideration of mining rigs optimized for Ethereum, leveraging GPUs capable of handling Ethash algorithm complexities with high throughput. Diversifying mining efforts by integrating rigs specialized for altcoins like DOG — which tends to rely on Scrypt-based miners — can buffer exposure and potentially unlock marginal gains in volatile markets.

Beyond the machinery, hosting mining rigs in state-of-the-art mining farms emerges as a compelling strategy to boost ROI. Mining farms, often located in regions with favorable energy policies or abundant renewable resources, reduce overhead costs considerably. For example, situating a mining farm in Iceland or certain Canadian provinces can capitalize on low-cost, green energy, drastically reducing both expenditure and carbon footprint. Hosting not only shields miners from the complexities of maintenance and cooling but also offers scalability, enabling quicker adaptation to market or network fluctuations. Importantly, hosting providers are increasingly incorporating smart grid technologies and AI-driven resource management, thereby optimizing power distribution and enhancing the overall uptime essential for continuous mining operations.

For Bitcoin miners, the volatile price capriciousness underscores the need for dynamic adjustment of mining strategies. Monitoring the BTC network difficulty, block rewards, and transaction fee trends allows miners to anticipate profitability shifts and recalibrate mining intensity or switch to mining auxiliary coins temporarily. Indeed, smart miners often leverage mining pools, aggregating computational power to level the playing field and guarantee steady payouts. Pools dedicated to ETH and DOG also exist, offering similar risk mitigation through distributed hashing power and reduced variance. However, the decision between solo and pool mining demands a careful analysis of hardware capability versus potential reward frequency.

Energy efficiency remains the linchpin of mining profitability strategies. Newer generations of mining machines embed power-saving features, but coupling them with renewable energy sources is the most forward-thinking approach. Solar-powered mining rigs and wind energy integration are gaining traction, underpinning sustainability while curbing operational costs. Additionally, adoption of smart cooling systems—leveraging ambient air temperatures, immersion cooling, or liquid cooling—can drastically reduce energy consumption associated with heat dissipation, a persistent challenge in large-scale mining operations.

On the financial front, miners need to navigate the complexities of crypto exchanges and stay abreast of market trends. Swiftly converting mined coins into fiat or stablecoins can protect profits from market retracements. Some exchanges now provide hybrid services, combining exchange functions with mining hosting, simplifying the ecosystem for miners. Furthermore, recent advancements in DeFi (Decentralized Finance) offer miners novel avenues to stake earnings or lend crypto assets, diversifying income streams beyond mere coin accumulation. For Ethereum miners, the advent of Ethereum 2.0 and its shift to proof-of-stake introduces longer-term strategic considerations, including potential migration from mining to staking to maintain profitability.

Keeping abreast of protocol updates and network forks is also essential. Significant network upgrades—such as Bitcoin’s Taproot or Ethereum’s EIP-1559—can influence transaction fees and mining rewards. Savvy miners track these changes to optimize operational parameters and exploit new profit opportunities, such as fee priority adjustments or mining priority transactions. Moreover, emerging coins with innovative consensus mechanisms might offer compelling niche profitability, warranting exploration beyond established currencies.

In conclusion, mining profitability in 2024 hinges on a multi-faceted approach combining cutting-edge mining hardware, strategic hosting arrangements, energy optimization, and savvy financial maneuvers. Whether capitalizing on Bitcoin’s robust network, harnessing Ethereum’s versatile ecosystem, or exploring altcoins like Dogecoin for diversification, miners equipped with expert strategies stand poised to maximize returns amid a complex and shifting crypto landscape. Continual adaptation and technological integration will define the leaders in this high-stakes pursuit of cryptocurrency wealth generation.